Page 42 - AA 2022 YEAR BOOK

P. 42

Saudi Arabia

SAUDI ARABIA FRUITS AND VEGETABLES MARKET -

GROWTH, AND FORECASTS (2022 - 2027)

reached 3,195,046.0 metric ton in 2019. to meet the domestic demand. Yemen,

These initiatives are expected to reduce the United Arab Emirates, Kuwait, and

Saudi Arabia’s dependence on imports Turkey are the major export trade part-

and boost domestic production in the ners of Saudi dates. The region of Ma-

country. dina Tayyiba grows Ajwa dates, which

are known for their luscious and fruity

Dates Dominate the Fruit taste and fine texture. The demand for

and Vegetable Trade dates is considered to be inelastic to a

degree because of the fruit’s prominent

Dates are one of the most traded role in the Ramadan fasting tradition and

commodities in Saudi Arabia, and the Islamic culture as a whole. Saudi traders

Market Overview country produces one-sixth of the dates stand to benefit from a growing interna-

grown all over the world. Although the tional demand for dates, and the exports

The Saudi Arabia fruits and vegeta- country is a major exporter of dates, im- of dates are projected to rise during the

bles market is projected to register a ports are also significant and necessary forecast period.

CAGR of 5.2% during the forecast pe-

riod, 2021-2026.

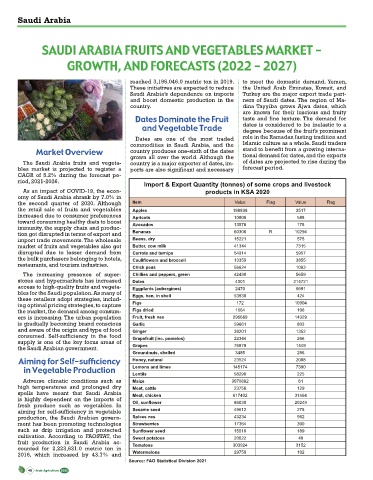

Import & Export Quantity (tonnes) of some crops and livestock

As an impact of COVID-19, the econ- products in KSA 2020

omy of Saudi Arabia shrank by 7.0% in

the second quarter of 2020. Although Item Value Flag Value Flag

the retail sale of fruits and vegetables Apples 188838 3517

increased due to consumer preferences Apricots 10808 588

toward consuming healthy diets to boost Avocados 13578 175

immunity, the supply chain and produc-

tion got disrupted in terms of export and Bananas 60306 R 10294

import trade movements. The wholesale Beans, dry 15221 575

market of fruits and vegetables also got Butter, cow milk 41344 7315

disrupted due to lesser demand from Carrots and turnips 54914 5957

the bulk purchasers belonging to hotels, Caulif owers and broccoli 13359 3855

restaurants, and tourism industries.

Chick peas 56624 1083

The increasing presence of super- Chillies and peppers, green 42430 5659

stores and hypermarkets has increased Dates 4001 214721

access to high-quality fruits and vegeta- Eggplants (aubergines) 2470 6691

bles for the Saudi population. As many of

these retailers adopt strategies, includ- Eggs, hen, in shell 53930 424

ing optimal pricing strategies, to capture Figs 172 10904

the market, the demand among consum- Figs dried 1664 106

ers is increasing. The urban population Fruit, fresh nes 296689 14329

is gradually becoming brand conscious Garlic 59661 803

and aware of the origin and type of food Ginger 38201 1352

consumed. Self-sufficiency in the food Grapefruit (inc. pomelos) 22344 266

supply is one of the key focus areas of

the Saudi Arabian government. Grapes 76879 1449

Groundnuts, shelled 3485 286

Aiming for Self-suff ciency Honey, natural 23524 2008

in Vegetable Production Lemons and limes 145174 7390

Lentils 58296 225

Adverse climatic conditions such as Maize 3070882 61

high temperatures and prolonged dry Meat, cattle 23756 129

spells have meant that Saudi Arabia Meat, chicken 617402 31464

is highly dependent on the imports of

fresh produce such as vegetables. In Oil, sunf ower 86030 20249

aiming for self-sufficiency in vegetable Sesame seed 49612 278

production, the Saudi Arabian govern- Spices nes 43234 962

ment has been promoting technologies Strawberries 17364 300

such as drip irrigation and protected Sunf ower seed 15018 189

cultivation. According to FAOSTAT, the Sweet potatoes 20622 40

fruit production in Saudi Arabia ac-

counted for 2,223,631.0 metric ton in Tomatoes 303924 3152

2016, which increased by 43.7% and Watermelons 29750 102

Source: FAO Statistical Division 2021

40 Arab Agriculture 2022